Despite expectations for mortgage rates to decrease after the Federal Reserve’s half-point rate cut last month, they have instead moved higher. Recent data from Freddie Mac shows the average 30-year mortgage rate has climbed to 6.4%, more than a quarter-point above where it was just two weeks ago. This shift may come as an unwelcome surprise to those waiting for lower rates to jump into the housing market.

Let’s break down what’s driving these changes and how they affect potential homebuyers.

Mortgage Rates Aren’t Set by the Fed

While the Federal Reserve plays a role in influencing interest rates, it doesn’t directly determine mortgage rates. Mortgage rates are largely driven by the yield on 10-year Treasury bonds, which has risen recently. Several factors have pushed yields higher, including investor expectations that the Fed will proceed more cautiously with future rate cuts following last month’s significant reduction.

Other Factors Contribute to Mortgage Rate Changes

The 10-year Treasury yield isn’t the only variable impacting mortgage rates. Lenders also factor in their own operating costs, profit margins, and risk assessments when setting rates. As a result, the rate you’ll be offered will depend on individual factors such as your credit score, the loan amount, and the mortgage type you choose.

Rates Remain Lower Than Last Year

Although mortgage rates have ticked up recently, they’re still more than a full percentage point below where they were at this time last year. This decrease can be attributed to investors pricing in anticipated Fed rate cuts, which have already impacted Treasury yields.

Refinancing Could Still Benefit Homeowners

The recent decline in rates compared to last year has opened refinancing opportunities for many homeowners who bought properties during periods of higher rates. Refinancing now could significantly reduce monthly payments, helping homeowners save hundreds of dollars.

Where Are Mortgage Rates Headed Next?

Forecasting mortgage rate trends is challenging due to the many factors involved. However, experts generally agree that rates are unlikely to return to the historically low levels of recent years. For example, in 2019, the 30-year fixed mortgage rates ranged between 3.75% and 4.5%, dropping to a record low of 2.65% in early 2021 during the pandemic.

Current projections suggest rates may hover around 6% by the end of the year and could dip to approximately 5.8% next year. Lawrence Yun, chief economist at the National Association of Realtors, suggests that a 6% mortgage rate might become the new norm. While rates could fall to 5.5% if conditions are favorable, there’s also the possibility they could climb back toward 7% in less favorable scenarios. Regardless, Yun believes the era of 3% and 4% mortgage rates is likely over.

Should Homebuyers Wait or Act Now?

In a fluctuating rate environment, it’s challenging to decide whether to buy now or wait for rates to drop. Experts advise against trying to time the market, including when purchasing a home. If rates decline after you buy, you can always refinance and secure a better deal. On the other hand, if rates go up, buying becomes even less affordable. Additionally, home prices tend to increase over time, so waiting could result in higher property costs.

Yun points out that even those who purchased homes during periods of much higher mortgage rates, such as the 15% rates of the early 1980s, have often benefited from rising home values and the ability to refinance at lower rates.

Is There Any Good News for Buyers?

The housing market is showing some positive signs for buyers. Inventory has increased, with the number of homes for sale in September up by 6.4% from the previous month and 33.6% from the prior year, according to a report covering 52 markets. Homes are also staying on the market longer, indicating a shift towards less competition.

Fewer buyers are currently seeking mortgages, with mortgage application rates dropping for three consecutive weeks, although they are still 7% higher than at this time last year. This slowdown could signal more opportunities for potential buyers.

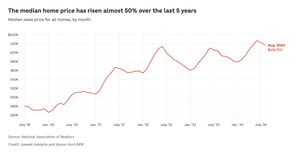

Home Prices Remain Elevated

While mortgage rates are a significant factor, high home prices also play a role in the market’s challenges. Since early 2020, the median home price has surged about 50%, largely driven by the pandemic. Although price increases have slowed, they haven’t significantly declined. As of August, the median sales price for existing homes was $416,700, roughly 3% higher than a year ago.

Seasonality Influences Market Activity

Home buying traditionally picks up in the spring and peaks in June, when the end of the school year and warmer weather encourage more activity. The market tends to slow down in late summer, with the quietest period usually occurring in the winter. For those who can find suitable properties, fall may present an opportunity to take advantage of less competition and potentially negotiate better terms.

Looking ahead, Fannie Mae predicts that home sales could rise by 10% next year, following a period of low activity. However, the market may not pick up substantially until spring.